The final date to submit an application for assistance was 04/30/24. Applicants who submitted their applications on or before 04/30/24 can still submit pending documentation through close of business on 06/30/24. These applications only impacted the 1st half of 2024 property taxes, not the 2nd half.

There is assistance available for homeowners who have past due Property Taxes.

The following eligibility criteria must be met:

-

The applicant must own and reside in the property

-

The applicant must have suffered a financial hardship

-

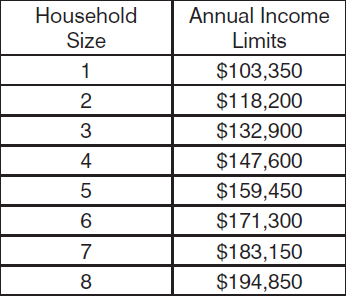

The applicant's current annual gross household income must be equal to or less than the amount listed below for their household size:

To obtain an application or for more information,

call 330-393-2507 extension 292